In the previous post I speculated on the lack of clarity about a “new normal” – even the name is wrong, perhaps we should be talking about our “next normal”. Do we want it to be the old normal – a concept of ‘bouncing back’ – or to take the opportunity to transform and ‘bounce forward’. Let’s revisit that idea by looping back to where I started in this series.

That was with a Continuity Central article from Michael Davies of ContinuitySA with some early observations and lessons to be learned from the pandemic. One of these observations related to the need to transform as part of the journey to build resilience;

digitalisation … is a primary driver of resilience in this new era

Digitalisation is another type of disruption for many organisations and industries. Digitalisation is not a new concept but it may get a significant kick along by organisations who are looking to exploit the upside of our current disruption.

The concept of risk has never been just about the downside – unfortunately Risk Management has tended to focus on that aspect. I wonder how many risk practitioners (and I include Business Continuity practitioners and those who added the word Resilience to their job title in this category) read and heeded the advice in this Risk Management Magazine (October 2019) article on “Dealing with Disruption”?

They will have learned that the concept of disruption is a significant risk to some companies continuing in business, as a result (according to research from Accenture) there has been a significant increase in reference to disruption in company briefings around earnings and at investor conferences. Thinking about disruption, and its impacts, has raised the anxiety levels of Executives in many industries. The RM Magazine article cites come Gartner research that offered a view on why Executives are anxious;

Part of the reason they may feel this risk so acutely is related to concerns around their own operations, including digitalization strategies and an inadequate talent pipeline

We have already seen reference to the “talent pipeline” aspect and how one company is exploiting the upside to expand their talent pool – the case of Worley in the previous post.

The article goes on to offer advice that we should be developing strategies for more than one version of the future, the multiple time horizon strategy and planning teams talked about in the first post of the series.

Of course, we need to revisit the way we think and prepare the organisation to respond. Disruption is not just about technology, something to be managed and planned. Neither is Digitalisation – it is a new way of behaving and thinking.

The more complex the problem is, the greater the need for risk frameworks that are flexible and less detailed. Risk managers need to respond to rapid changes, and detailed plans simply don’t work—they are too rigid and often address only part of the problem and/or solution. Plans, planners, planning and procedures all need to be agile.

So said Sean Murphy, managing director of professional services firm BDO’s crisis management and business continuity practice.

Uncertainty is rife in this pandemic, as it most likely will remain in the immediate post-pandemic world. Agile approaches help us deal better in conditions of uncertainty. We need to prepare ourselves and our organisations for this world.

But beefore we can help our organisations to prepare, we need a clear picture of what we mean when we talk about this digital disruption – and how the pandemic impacts it all.

We have all seen the pressure to digitisation – and most of us are probably using it in some way. We may scan a document and file that rather than the paper version. Digitisation refers to converting things from a physical to a digital format. I still have my collection of vinyl albums, but I am more likely to listen to the versions I have digitised onto my iPhone. Perhaps a millennial would have digitised the physical files I downloaded and only deal with streaming music.

Digitalisation is where we use the digitalised output as means to improve business processes – or indeed to create a whole new line of products. A couple of very simple examples, specific things I have seen implemented during the pandemic;

- An organisation that required hard copy printed and physically signed timesheets for contract workers – implemented approvals within the time recording system and generation of PDF copies to attach to an invoice.

- Signing and witnessing procurement documents used to require physical paper and face to face witnessing. This migrated to attaching digital signatures within Adobe (for a PDF) combined with video calls/screen sharing to “witness” the digital signing.

The first is perhaps digitisation without digitalisation – the business process for paying invoices is the same. The second example improved the process of approving procurements. Small things but they have the potential to change the way we think about these basic processes – and to uncouple them from the need to all be in the “office” to make it happen.

The impact of changing these business processes is where digital transformation, or digital disruption comes in. My daily newspaper has been digitised and the delivery mechanism is no longer a paper boy on a bicycle – which was one of the first jobs I had as a lad. Ultimately it can disrupt the entire industry printing, paper supply – where and when journalists can work.

Money was digitised, so during the pandemic most stores I have been to wont take cash payment. Contactless smart cards rule.

Netflix and digitalised streaming entertainment has boomed during the pandemic.

I needed new computer equipment to augment work from home, I ordered it online and it was delivered to my door. Online shopping has boomed in the pandemic. Online ordering channels probably represent the first wave of digital transformation for many organisation. A digital front end to a physical model of fulfilment. Some will also have worked through into the second wave, where we look to rethink the digitalisation of the entire organisation.

If you haven’t already been hit by that second wave of transformation, this may be the time to start thinking about it. Leverage the upside of what is changing to accomodate the pandemic isolation and lockdown.

There is a third wave coming, AI, big data, internet of things, 5G – all combine to to present opportunities for disruption and leverage. Bots are already here and they don’t spread or contract Covid19.

To be resilient we need to be able to understand the big picture and the issues and challenges facing the organisation at a level of above the routine and operational level. Back in 2012 the Australian Government commissioned some research on resilience that sought to understand it from a CEO’s perspective.

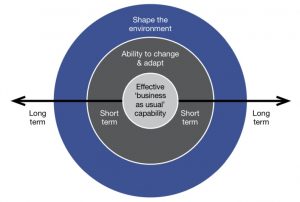

The authors (Kay & Goldspink) created the graphic at the start of this post – it was meant to represent a maturity model for organisational resilience as well as the elements of a fully resilient organisation. It represents the ability to survive at the core, to bounce back in the middle and the potential to bounce forward at the outer level. The full report is free and available here.

How mature is the resilience of our practice? Did we prepare our organisations to exploit the upside, or just to survive?

How resilient is your organisation? Are you able to adapt and exploit the opportunities being presented by the Covid19 disruption?

Leave a Reply